This system is subject to monitoring. Goods or class of goods that are exempted from sales tax are listed in the Schedule A of the Sales Tax Exemption Order 1980.

A Complete Guide To Sales Tax Exemptions And Exemption Certificate Management

Similarly the State Governments levied taxes on retail sales in the form of value added tax entry of goods in the State in the form of entry tax luxury tax and purchase tax etc.

. Sales and Use Tax Frequently Asked Questions. Visits to the manufacturing. Tax compliance season for Income Tax Return filing of AY.

Utilisation of input tax credit subject to certain conditions. A GST Returns is a document that contains information about the income that a taxpayer must file with the authorities. The rate would be adjusted for inflation beginning in July 2022.

During a meeting with the New York Times Editorial Board in January 2016 Trump said he. We have discussed some key amendments introduced in the Finance Act 2021 in this article. F goods or services or both received by a non-resident taxable person except on goods imported by him.

Unless a sale is exemptedexcluded by the Sales and Use Tax Act New Jersey imposes a tax of 6625 upon the receipts from every retail. The manufacturer is required to disclose the particulars in respect of raw materials and components the finished goods as well as the proposed formula for the computation of drawback. In addition to all other exemptions granted under this chapter there is hereby specifically exempted from the provisions of sections 144010 to 144525 and 144600 to 144761 and section 238235 and the local sales tax law as defined in section 32085 and from the computation of the tax levied assessed or payable under sections 144010 to.

Additionally the state levied 18centpergallon excise taxes on gasoline and diesel fuels. Interest on delayed payment of tax. G goods or services or both used for personal consumption.

Property on which sales tax paid. The storage use or other consumption in this State of property the gross receipts from the sale of which are required to be included in the measure of the sales tax is exempted from the use tax. MSTC Data Centre shall be relocated from its present location to New Town Kolkata during the period from 6th August 2021 to 8th August 2021.

Exempted from the tax in Hawaii New York and Washington are 100 percent fruit juice unsweetened milk products dietary aids and infant. Revenue is intended for public health spending. During the 2016 presidential campaign Trump repeatedly favored policy proposals that renegotiate trade agreements for the United States.

In 2010 the Legislature enacted the fuel tax swapa combination of sales tax and excise tax changes designed to give the state more flexibility in. NRS 372345 Use tax. Taxability of Purchases of Tangible Personal Property and Services Associated with Disaster Recovery Efforts.

This information used to compute the taxpayers tax liability. Accordingly there is multiplicity of taxes which are being levied on the same supply chain. H goods lost stolen destroyed written off.

The Tax Reform for Acceleration and Inclusion Law TRAIN Law officially designated as Republic Act No. Difficulties faced under erstwhile taxation laws shall be listed as below. Poll Vote for GST Portal performances and view the poll result here.

Trump adopted his current views on trade issues in the 1980s saying Japan and other nations were taking advantage of the United States. The TRAIN Act is the first of four packages of tax reforms to the National Internal Revenue Code of 1997 or the Tax Code. The GST rates for various products have been revised several times by the GST council since the inception of the Goods and Services Tax.

Goods and services tax practitioners. The GST rates are usually high for luxury supplies and low for essential needs. Tax deduction at source.

Prior to 2010 California applied the same sales tax rate to fuel as it did to other goods. The government proposes to levy 10 sales tax on low-value goods costing less than RM500 which are bought online from foreign vendors. Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales of goods and merchandise except those sales specifically exempted by law.

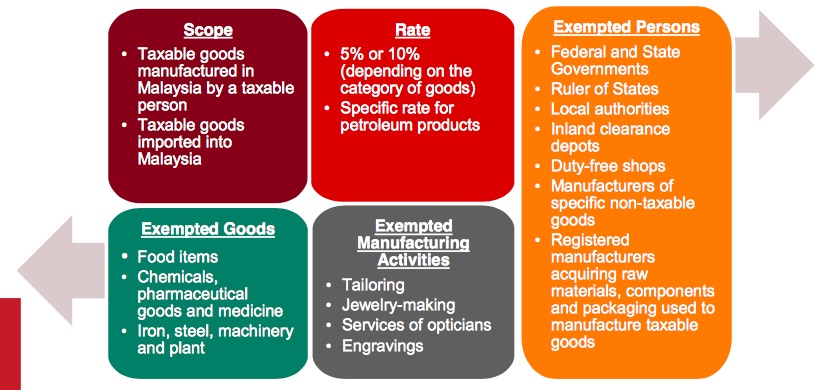

Companies Manufacturer or Sub-contractor with a sales value of taxable goods exceeded RM500000 for 12 months period are liable to be registered under the Sales Tax Act 2018. Proposed Goods Exempted From Sales Tax more Service Tax FAQ BM more Sales Tax FAQ BM more See More. Individuals found performing unauthorized activities are subject to disciplinary action including criminal prosecution.

Goods which are not exempted through Proposed Sales Tax Goods Exempted From Sales Tax Order will be charged sales tax at various rates 5 to 10 prescribed. They are 5 GST 12 GST 18 GST 28 GST. Sales and Use Tax Frequently Asked Questions.

During this period only skeletal services shall be maintained and all major important activities including payment of global pre bid EMD and other online payments for auctions shall remain suspended. PM - Budget 2015 Speech Text more See More. 10963 is the initial package of the Comprehensive Tax Reform Program CTRP signed into law by President Rodrigo Duterte on December 19 2017.

E goods or services or both on which tax has been paid under section 10. INSTAVAT Info Private Ltd Maharashtra Andhra Pradesh State India professional consultants having experience in the field of Sales Tax of more than 25 yearsSales tax is charged at the point of purchase for certain goods and services in Maharashtra State IndiaService tax charged on service providers in Maharashtra State India. Different Sales Tax Rates Apply to Fuel.

Extent of capitalisation to the said immovable property. The 4225 percent state sales and use tax is distributed into four funds to finance portions of state government General Revenue 30 percent. 175 cents per ounce.

The use tax generally applies to the storage use or other consumption in. In Washington the tax rate proposed is equal to the rate in Seattle. 2021-22 is on the way and thus it is pertinent to note key amendments made in the Finance Act 2021 which are applicable with effect from Assessment Year 2021-22.

Which will help professionals. Under the Goods and Services Tax registered dealers must file their GST returns with details regarding their purchases sales input tax credit and output GST. In India GST rate for various goods and services is divided into four slabs.

Payment of tax interest penalty and other amounts. That will incur sales tax under a proposed new rule. VAT tax collected at every transaction for a.

Order of utilisation of input tax credit. The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retailUse tax is imposed on the storage use or consumption of tangible personal property in this state. We offer you a range of convenient payment options.

Exempt Supply Under Gst Includes Nil Rated Taxable At 0 Non Taxable Supplies Persons Dealing Exclusively In Nil Rated Goods And Services Supply Supplies

Sales And Use Tax Regulations Article 3

Gst Exempt Supply List Of Goods And Services Exempted

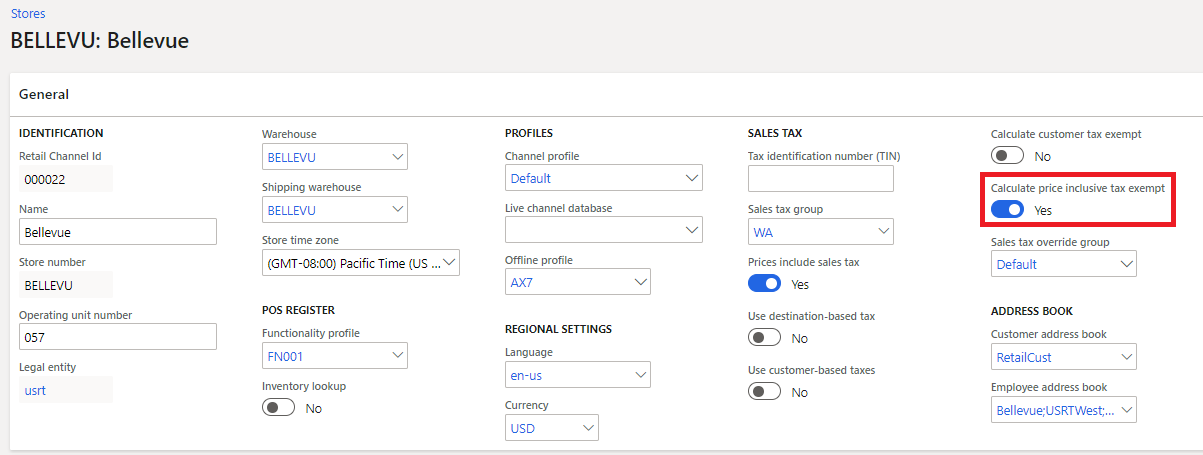

Calculation Of Tax Exemption Commerce Dynamics 365 Microsoft Docs

Tax Updates Union Budget 2021 Online Accounting Software Budgeting Cloud Accounting

Malaysia Proposed Sales And Service Tax Sst Implementation Framework Conventus Law

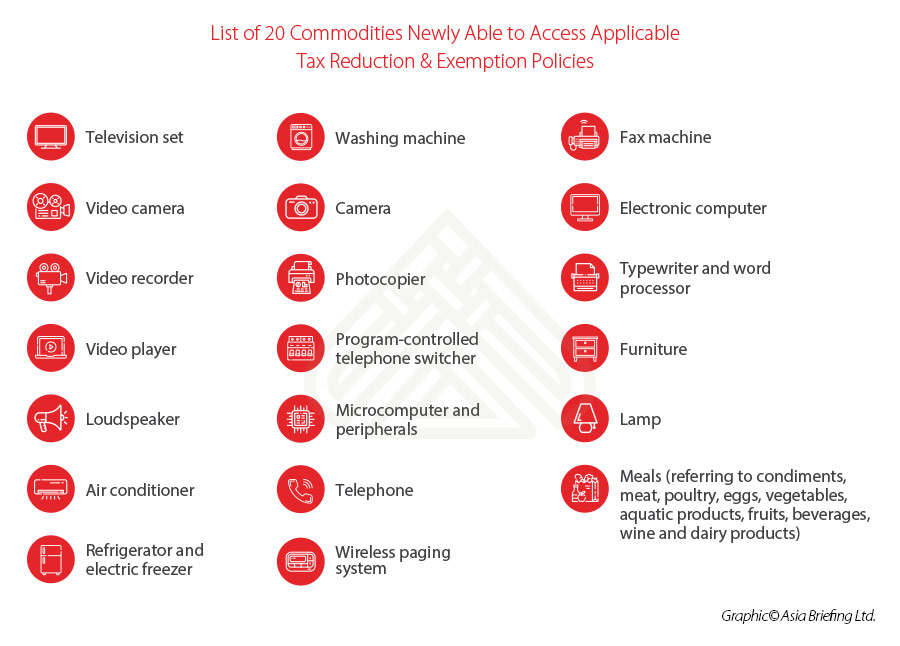

China Reinstates Import Tax Reduction And Exemption For 20 Commodities

Sales And Use Tax Regulations Article 11

Sales And Use Tax Regulations Article 3

Sales And Use Tax Regulations Article 3

Gst Overview Http Www Accounts4tutorials Com 2017 06 Gst Short Notes Html Goods And Service Tax Goods And Services Accounting Help

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation

Sales And Use Tax Regulations Article 3

Sales Tax Challenges For Manufacturers Distributors

Sales And Use Tax Regulations Article 11

Understanding California S Sales Tax